Basic Chequing Account

ICICI Bank Canada’s Basic Chequing Account is specially designed for those who only need to conduct a few banking transactions every month. At a low monthly fee, you can enjoy all the essential features and services you require while earning interest on your money.

The Basic Chequing Account is available at a low monthly fee of $4.00. This fee is waived1 for:

- Seniors

- Students (enrolled full time in post-secondary program) (Opening of the account is currently available only through our branches)

- Youth (Opening of the account is currently available only through our branches)

- Registered Disability Savings Plan (RDSP) beneficiaries (Opening of the account is currently available only through our branches)

Currency: Available in Canadian Dollars

Earn interest on your Canadian Dollar Chequing Account.

- Withdrawal transactions: 12 free debit transactions2

- Deposit transactions: Free and unlimited

- Access your funds: Online, by phone, in-branch or at over 3,600 ABMs located at our branches or on THE EXCHANGE® Network3. To find an ABM near you, click here

- Paper statement: Free

- TEXT ALERTS service: Receive instant text messages on your mobile phone confirming credit or debit transactions of $50 or more, upon registration

- Money Transfers: Low cost money transfers to India and other countries

- Transfer money online between your linked accounts: Link your Basic Chequing Account with up to 3 external chequing accounts at any Canadian financial institution for quick and easy transfer of your funds.

- Safe and Secure: ICICI Bank Canada is a member of CDIC. Learn more about Canada Deposit Insurance.

To open an account, please visit one of our branches.

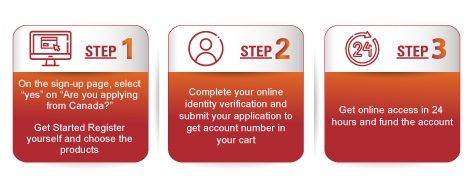

Open your Basic Chequing Account in 3 Easy Steps:

1 Proof of eligibility is required: For seniors (60 years and above) / youth (12 to 19 years), proof of age; for students, proof of full-time enrollment at a post-secondary institution; for RDSP beneficiaries, proof of beneficiary status on an RDSP.

2Customers who hold a Basic Chequing Account can perform 12 debit transactions via Internet, telephone, in-branch or at an ABM at no charge. These transactions include debit card purchases, cash withdrawals, bill payments, pre-authorized debits, account transfers and cheque issuance. For any transactions made over and above the first 12 debit transactions during a month, the charges set out in our Disclosure Statement of Fees and Charges for Personal Accounts will apply, plus an additional fee of $1.00. For detailed information on all services and charges, please refer to the Bank's Disclosure Statement of Fees and Charges for Personal Accounts.

3 Neither ICICI Bank Canada nor any of THE EXCHANGE network ABM providers impose a surcharge for ABM deposits, withdrawals and inquiries.

All interest rates are expressed on a per annum basis and are subject to change any time without notice. Interest on a Canadian Dollar Basic Chequing Account is calculated on the daily closing balance and paid monthly. Rates are subject to the account balance requirements set out above.