Safe Cheque Book Tips

Cheque Book Safety Measures:

Tips To Keep Your Cheque Book Safe

- Record all details of cheques issued.

- Do not leave your cheque book unattended. Always keep it in a safe place,

- Whenever you receive your cheque book, please count the number of cheques in it. If there is a discrepancy, bring it to the notice of the Bank immediately.

- Verify serial continuity of the cheque numbers. If there is a discrepancy, bring it to the notice of the Bank immediately.

- Inform the Bank immediately if you lose/misplaced your cheque book, a cheque or a requisition slip.

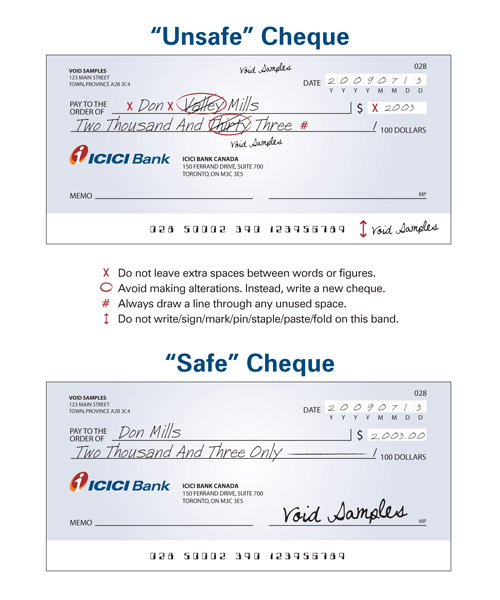

Tips To Write A Cheque Correctly

- Do not sign blank cheques. Always fill in the date, the name of the receiver and the amount before signing the cheque.

- Always draw a line through any unused space.

- Never sign in multiple places unless authenticating a change.

- Avoid using cheques with errors or spelling mistakes on them. Issue a new cheque if possible.

- When you cancel a cheque, mutilate the MICR band and write “CANCEL” across the face of the cheque

- Do not write/sign/mark/pin/staple/paste/fold on the MICR band.

- Unused requisition slips should be destroyed or returned to the bank.

- Use the transaction sheet to record details of cheques issued by you.

Contact Us

Please call us toll-free at 1-888-424-2422 or email us at customercare.ca@icicibank.com

- if you find any discrepancy in the number of cheques of the cheque book you receive

- if you have lost an issued cheque and need to give a "stop payment" instruction; or

- to request a new cheque book