Complaint Resolution Statistics

ICICI Bank Canada consistently strives to provide resolutions to complaints that are timely, fair and reasonable to both the customer and the Bank. Complaint Regulations issued by the Financial Consumer Agency of Canada require the Bank to publicly report its complaint resolution statistics on an annual basis.

| Annual Statistics | 2024 |

|---|---|

The number of complaints resolved by the Senior Complaints Officer of the Bank |

32 |

The average length of time taken by the Senior Complaints Officer to deal with the complaints |

9 days |

The number of complaints that were resolved to the satisfaction of the customer, in the opinion of the Bank |

26 |

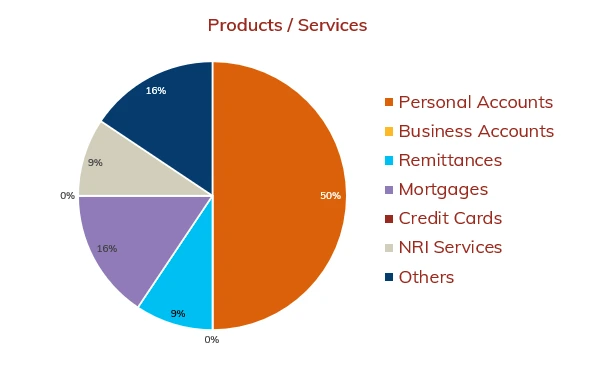

These Complaints are divided among the Bank’s products or services as follows:

| Products / Services | Count |

|---|---|

Personal Accounts |

16 |

Business Accounts |

0 |

Remittances |

3 |

Mortgages |

5 |

Credit Cards |

0 |

NRI Services |

3 |

Others |

5 |

For the fiscal year ending December 31, 2024, our analysis indicates a decrease in client complaints, and these complaints reflect a range of concerns encompassing various banking services. With economic dynamics evolving, clients continue to encounter challenges in managing their financial affairs.

Transfer procedures and Other services dominate the categories of complaints, collectively constituting 41% of complaints. Internet banking/services and renewal issues each accounted for 13% of complaints, while account opening issues and teller services represent 9% each. The analysis highlighted that the overall number of complaints in most areas improved or remain stable.

Approximately 19% of complaints pertained to miscellaneous issues falling outside specific product categories, underscoring broader service-related grievances. Most encompassed difficulties with other Financial Institutions. Notably, complaints regarding agreements, fees/charges, and transactions services each stood around 3%, suggesting relative satisfaction in these areas based on client feedback.

We remain committed to addressing and resolving client concerns while continually enhancing our services to better meet the evolving needs of our valued clients