Basic Chequing Account

ICICI Bank Canada’s Basic Chequing Account is specially designed for those who only need to conduct a few banking transactions every month. At a low monthly fee, you can enjoy all the essential features and services you require while earning interest on your money.

The Basic Chequing Account is available at a low monthly fee of $4.00. This fee is waived1 for:

- Seniors

- Students (enrolled full time in post-secondary program) (Opening of the account is currently available only through our branches)

- Youth (Opening of the account is currently available only through our branches)

- Registered Disability Savings Plan (RDSP) beneficiaries (Opening of the account is currently available only through our branches)

- Newcomers to Canada (For 1st Year)

- Recipients of the Disability Tax Credit (Opening of the account is currently available only through our branches)

- Indigenous peoples (Opening of the account is currently available only through our branches)

Currency: Available in Canadian Dollars

Earn interest on your Canadian Dollar Chequing Account.

- Withdrawal transactions: Free and unlimited

- Deposit transactions: Free and unlimited

- Access your funds: Online, by phone, in-branch or at over 3,000+ ABMs located at our branches or on THE EXCHANGE® Network3. To find an ABM near you, click here

- Paper statement: Free

- TEXT ALERTS service: Receive instant text messages on your mobile phone confirming credit or debit transactions , upon registration

- Money Transfers: Low cost money transfers to India and other countries2

- Transfer money online between your linked accounts: Link your Basic Chequing Account with up to 3 external chequing accounts at any Canadian financial institution for quick and easy transfer of your funds

- Safe and Secure: ICICI Bank Canada is a member of CDIC. Learn more about Canada Deposit Insurance

To open an account, please visit one of our branches.

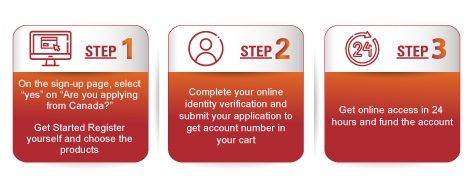

Open your Basic Chequing Account in 3 Easy Steps:

1 Proof of eligibility is required: For seniors (60 years and above) / youth (12 to 18 years), proof of age; for students, proof of full-time enrollment at a post-secondary institution; for RDSP beneficiaries, proof of beneficiary status on an RDSP.

2For detailed information on all services and charges, please refer to the Bank's Disclosure Statement of Fees and Charges for Personal Accounts.

3 Neither ICICI Bank Canada nor any of THE EXCHANGE network ABM providers impose a surcharge for ABM deposits, withdrawals and inquiries.

All interest rates are expressed on a per annum basis and are subject to change any time without notice. Interest on a Canadian Dollar Basic Chequing Account is calculated on the daily closing balance and paid monthly. Rates are subject to the account balance requirements set out above.